Application and Unapplication of Credits, Credit Notes, and Payments to Invoices

To gain access, an upgrade to your Tenant is required. To request your Tenant upgrade, contact your Customer Success Manager.

What is it?

- Credits, Credit Notes, and Payments are applied to Invoices to lower the Amount Outstanding on Invoices. They can also be unapplied from Invoices, resulting in an increase in the Amount Outstanding on Invoices.

- This feature allows Finance teams to update applications of Credits, Credit Notes, and Payments to/from Invoices.

Sample use cases

- After a Credit and Rebill creates a Credit Note, apply it to an Invoice

- Apply a Credit you manually created to an Invoice

- Move a Payment from one Invoice to other Invoices before

Actions you can take to achieve these use cases

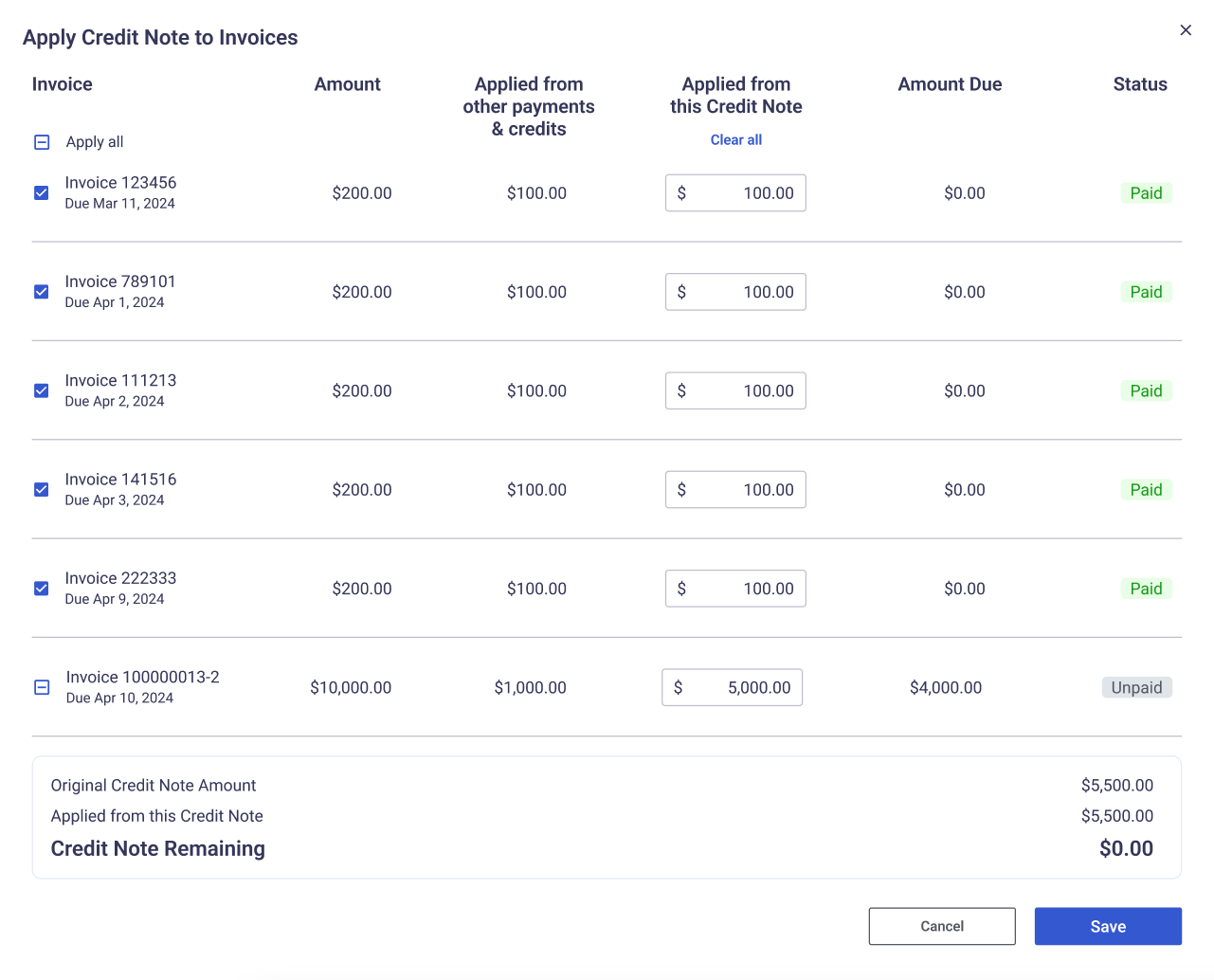

- Apply (or partially apply) a Credit, Credit Note, or Payment to an Invoice

- Unapply (or partially unapply) a Credit, Credit Note, or Payment from an Invoice

- Both 1 and 2 together

All actions are initiated from the Credit, Credit Note, or Payment.

Considerations

- Unapplying and applying Credits, Credit Notes, or Payments from Invoices can Impact the Invoice's status, moving it from Paid to Unpaid or vice-versa. Depending on how you report on Accounts Receivable and Accounts Receivable Aging, your reporting may be impacted.

- Unapplying and applying a Credit Note does not impact Credit Note Items, the line items that correspond to Invoice Items.

Is Unapplying a Payment the same as a Refund?

Great question - no.

An unapplication of a Payment refers to removing all or part of the Payment from an Invoice. A Refund refers to returning funds from a Payment to a customer.

Example

Assume you have an Invoice for $1,000 and a $1,000 Payment applied to that Invoice. At this point, the Invoice is fully paid and the Payment has $0 remaining to apply.

A user may choose to unapply the $1,000 Payment from that Invoice. Upon taking that action, the Invoice is now unpaid with an Amount Due of $1,000 and the Payment now has $1,000 remaining that can be applied to Invoices or Refunded.

Updated about 1 year ago