Anrok

Overview

You can utilize Anrok to calculate taxes on your invoices.

This guide will walk you through the following steps:

- Configuration

- Ensure Anrok is correctly configured for taxation

- Generate an API key in Anrok

- Connect MonetizeNow to Anrok

- Configure your product catalog in MonetizeNow and Anrok

- Tax Calculation

- Correcting Tax Errors

- Troubleshooting

Best PracticeAs with all integrations, it is a best practice to test your tax configuration using a sandbox.

Configuration

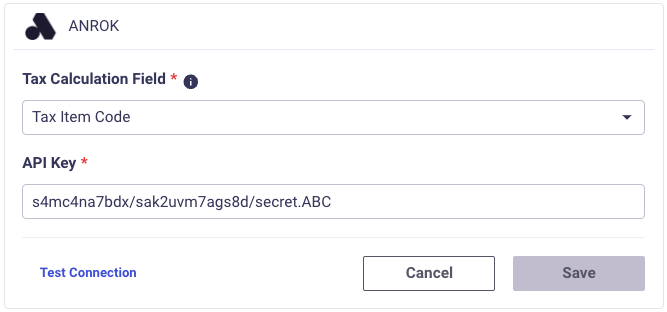

Connect MonetizeNow to Anrok

- Click the gear on the sidebar to open settings, and choose Tax under the Integrations section

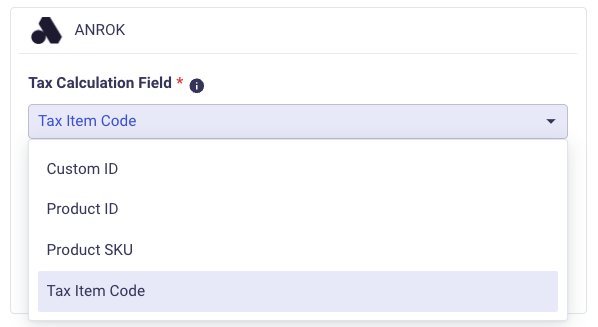

- Choose a Tax Calculation Field

- This option determines which field in MonetizeNow is mapped to Anrok's Product IDs. See more details in the following section.

- Enter your API key provided by Anrok

- Click Test Connection to ensure that your configuration is valid and press Save

Configure your product catalog in MonetizeNow and Anrok

In order for taxes to be correctly calculated by Anrok, you will need to configure your product catalog in both MonetizeNow and Anrok.

You will need to make sure that the products in MonetizeNow can be correctly mapped to the products in Anrok.

Configure product field

Choose which field from each product you would like MonetizeNow to send to Anrok for tax calculation.

Tax Item Code and Product SKU are usually the best options to choose from.

If you already have product identifiers in your systems, then it would make sense to set that as the Product SKU and choose that as the mapping value.

If you have many products that are the same with only minor variations, you may want to have multiple products in MonetizeNow map to just one product in Anrok, assuming the tax treatment is 100% identical. In this case, you may want to choose Tax Item Code as the mapping value.

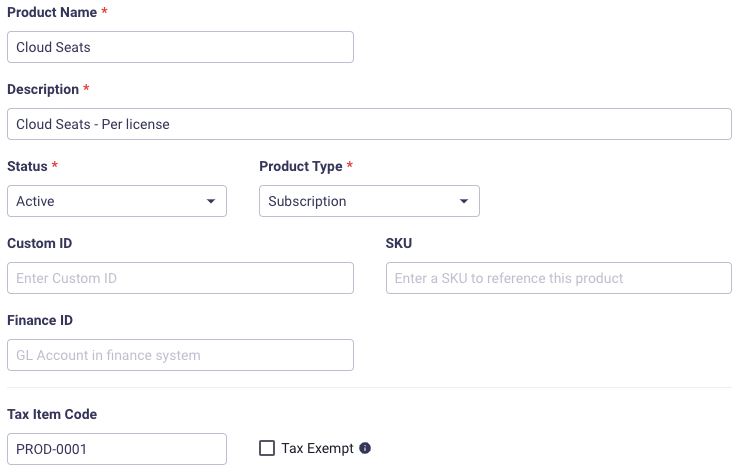

Configure your products in MonetizeNow

Based on how you configured the Tax Calculation Field, make sure that your product has a value in the appropriate field so that it can be mapped to Anrok.

Any time you add products to your catalog, you will need to ensure that there is a mapping to Anrok's product catalog.

It is a best-practice to include all of your products in Anrok and configure taxability within Anrok, but if you don't want MonetizeNow to send the product to Anrok for calculation, then you can select the "Tax Exempt" checkbox in MonetizeNow.

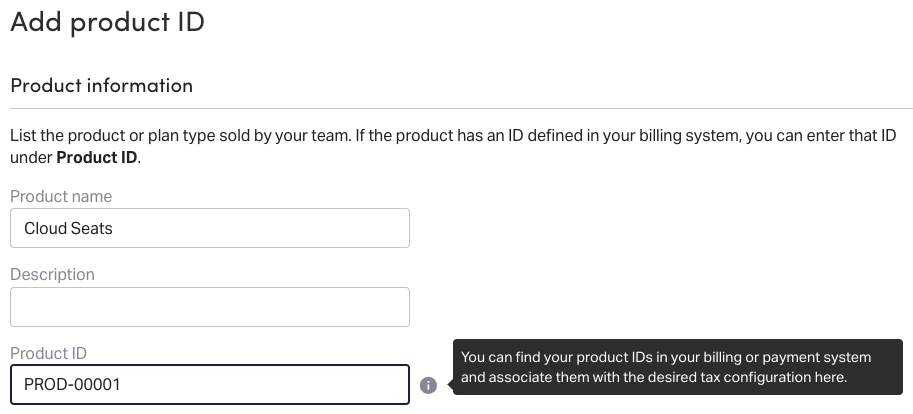

Configure Anrok's Product Catalog

Create all your products in Anrok with the proper tax treatment and ensure that the Product ID in Anrok is set to the same value as configured in MonetizeNow. The value chosen will vary depending on what Tax Calculation Field you selected in MonetizeNow.

Tax Calculation

Tax Addresses

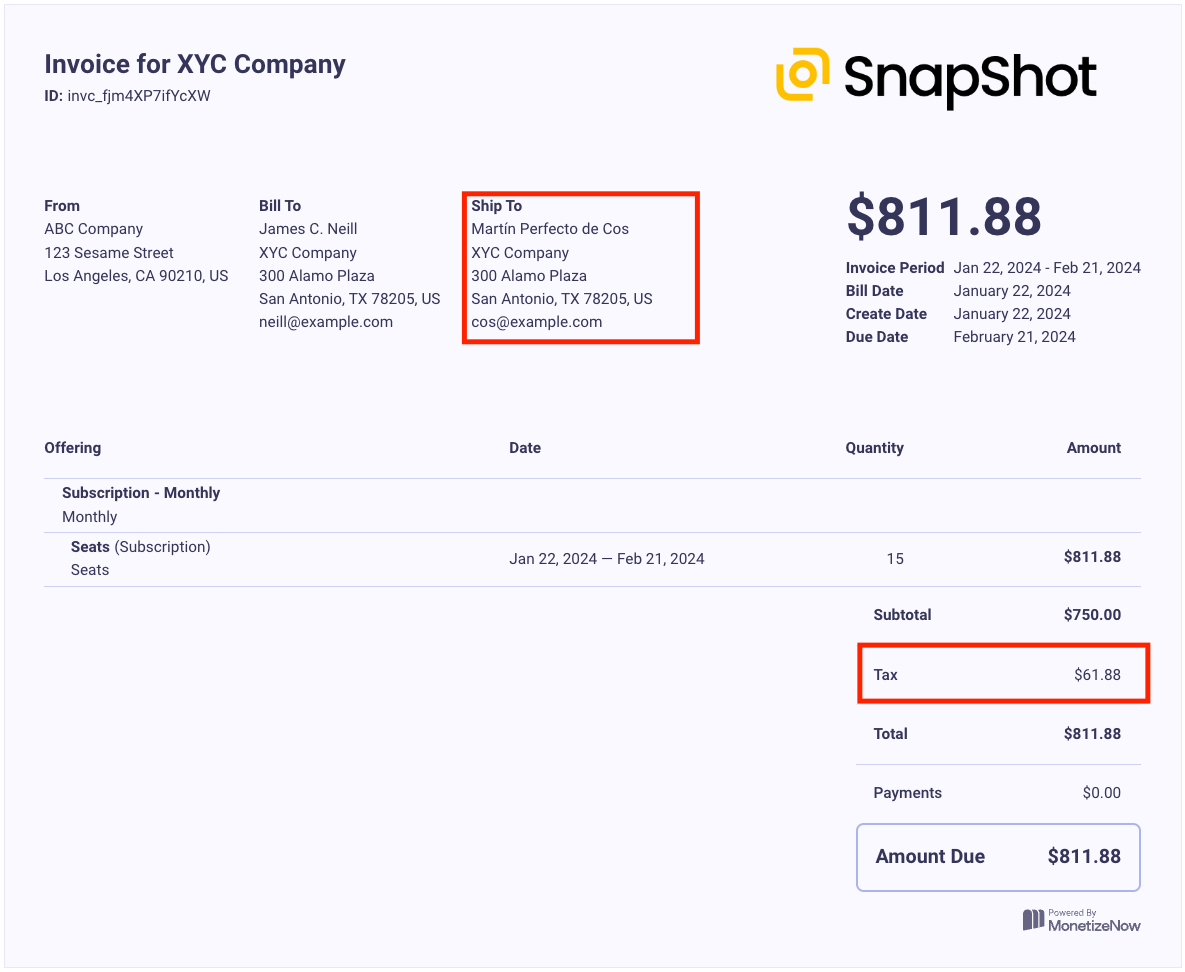

In order for Anrok to properly determine tax liability for an invoice, you must have accurate address details. MonetizeNow will send the Shipping Address to Anrok.

- The Shipping Contact's address on an invoice is used for tax calculations.

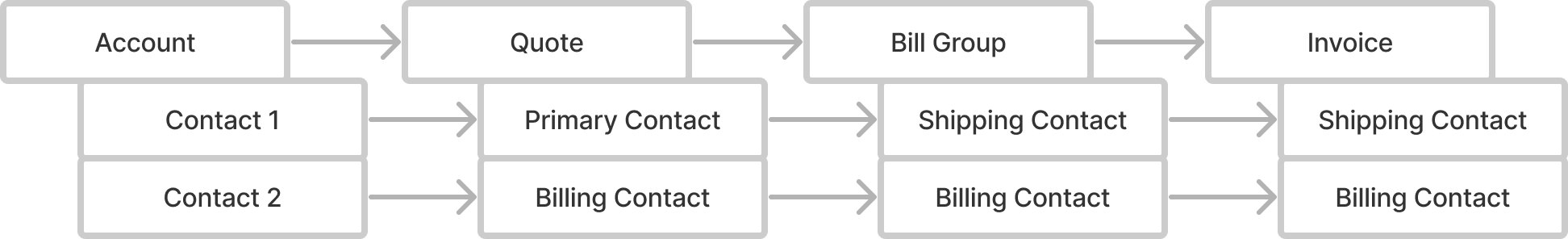

- Invoice contacts are sourced from the Bill Group's shipping and billing contacts.

- Bill Group contacts are set from the Quote's contacts. The Primary contact turns into the Shipping Address on the Bill Group once the quote is Processed.

Testing your configuration

- Ensure that you have configured your Tax Integration as described previously in this guide

- Create a new quote and add some products

- Create or select a primary and billing contact and ensure that a valid address is configured for a taxable jurisdiction, based on your Anrok configuration

- Move the quote through to Processed

- Navigate to the account and click on the Invoices tab

- Open the invoice and review the calculated taxes

Handling Incorrect Tax Amounts

It is possible that during the sales process, the address collected on the Quote was incorrect or incomplete.

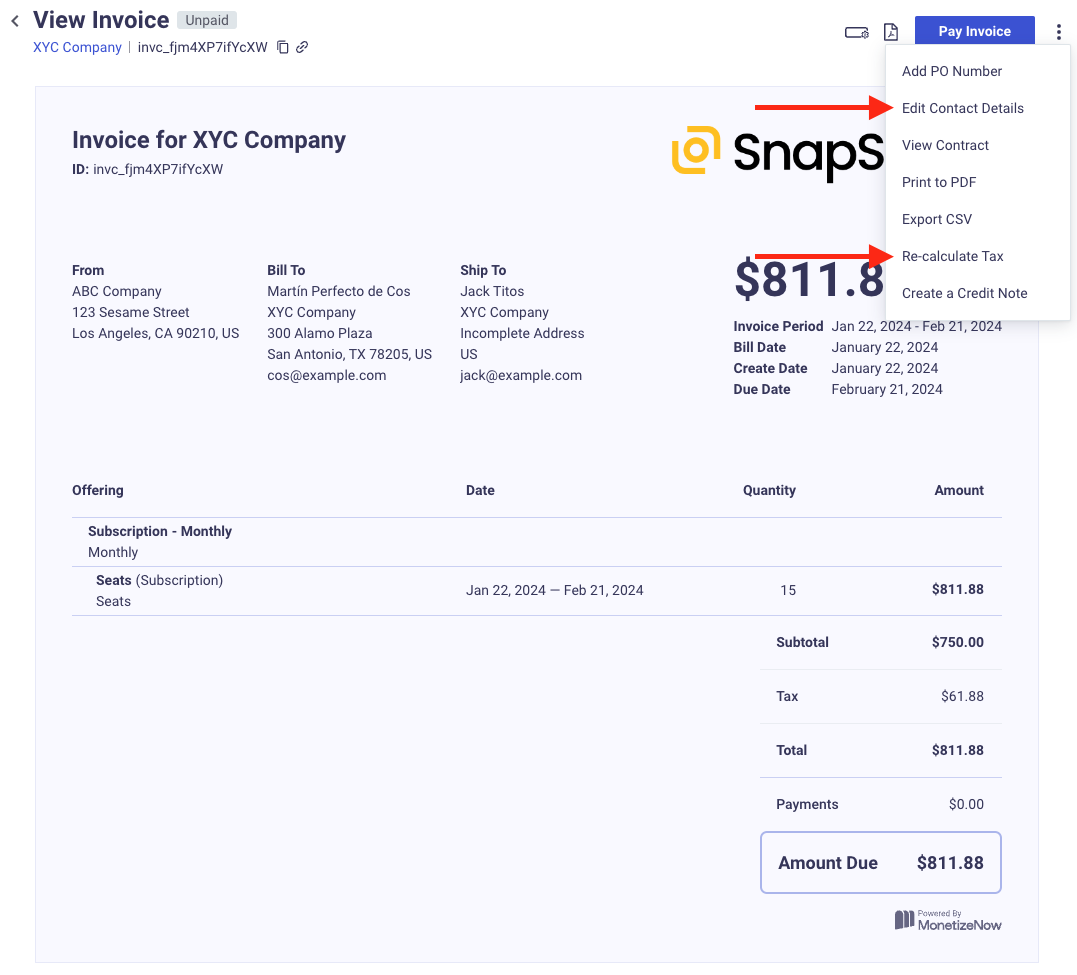

As long as the invoice has not yet been paid and does not have any credits applied, then you will have the ability to edit the contact details to re-calculate the tax.

- Open the invoice actions menu and choose Edit Contact Details

- Choose a different contact or edit the address details of the existing contact

- Save

- Open the invoice actions menu and choose Re-calculate Tax

Correcting Tax Calculation Errors

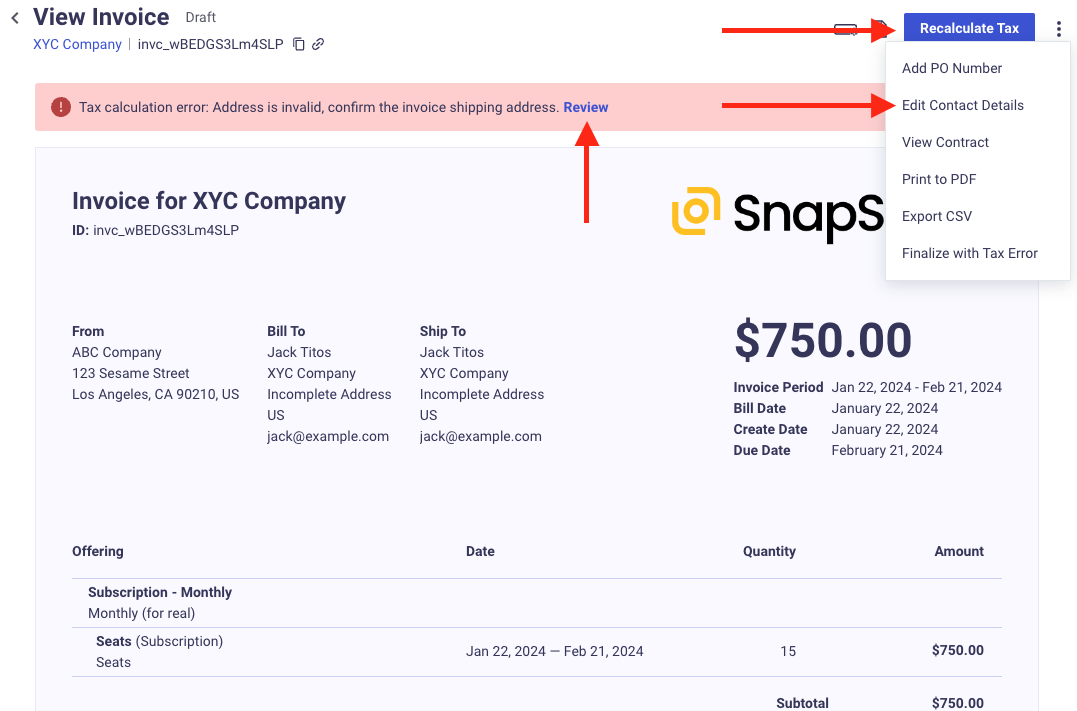

It is possible that tax calculation may have failed. When this happens, you will need to take action to fix the invoice and re-calculate the taxes.

You will need to review the error message displayed on the invoice to determine what action to take to make the correction. If possible, MonetizeNow will provide a Review link you can click on to get directed to where you need to correct the problem.

InformationWhen an invoice has a tax calculation error, it will remain in Draft status until you correct and finalize the invoice. The invoice cannot be emailed to your customer and cannot be paid while in Draft.

Additionally, no additional invoices for this bill group will be created until you resolve this invoice.

While not recommended, you can finalize the invoice without resolving the tax calculation error.

The most common errors are:

- The address is invalid

- Update the shipping contact's address to correct this

- The product was not found in Anrok

- Ensure the product exists in Anrok

- Review the Anrok configuration in MonetizeNow to see which product field is being sent to Anrok

- Review the Product in MonetizeNow and ensure that the value we are sending to Anrok matches the Anrok configuration

- Your Anrok API key is not valid

- Review the Anrok configuration in MonetizeNow and make sure you can test your connection successfully

Tax Exemptions

For tax exempt customers, you will need to upload the tax exempt certificate to Anrok so that taxes are not charged.

If your customer already exists in Anrok, then upload the certificate to the customer in Anrok.

If your customer does not yet exist in Anrok and you want to ensure they are configured for exemption prior to their first invoice, then you will need to manually create the customer in Anrok. Use the MonetizeNow account id as the Customer ID in Anrok.

Troubleshooting

An invoice does not include tax, but I expected tax to be calculated

- Ensure that the invoice start date is not before your Tax calculation start date for the jurisdiction in question based on what is configured in Anrok

- Ensure that the Shipping Address has a correct address

- Review the Transactions listed in Anrok for additional calculation information

Updated about 1 year ago